Policy Update

Akanksha Baronia

Introduction:

Countries have been attempting to improve supply chain linkages as well as searching for resilient and long-term value chains. Countries are interconnected and dependent on one another countries for production inputs leading to exports. The COVID-19 and subsequent trade measures have led to restricting the flow of goods and services between the countries. Today, value chain and intra-industry trade account for more than half of Asia’s trade. The pandemic is also seen as an opportunity to rebuild trade partnerships and supply chain linkages.

Supply chains need to be smarter, more sensitive, flexible,and technically viable resilient enough to move towards the sustainable value chain integration

Background:

For decades, global trade networks have relied heavily on China, which emerged as the world’s leading manufacturing hub. Yet, recent challenges such as the U.S.–China trade tensions, the COVID-19 pandemic, and ongoing geopolitical uncertainties in the Indo-Pacific have exposed the risks of depending too heavily on a single country. Against this backdrop, India and the ASEAN (Association of Southeast Asian Nations) are working to strengthen their economic cooperation in order to build supply chains that are more diverse, reliable, and less centered on China.

1. Reducing Overdependence

China’s central role in producing goods and components has made global trade vulnerable to sudden disruptions. India and ASEAN countries recognize the need to spread production and sourcing across different locations. By combining India’s expanding industrial base, skilled workforce, and large domestic market with ASEAN’s well-established regional production networks, both sides can serve as strong alternatives to China’s dominance.

2. Expanding Trade and Investment Links

ASEAN already stands as one of India’s key trade partners, and through its “Act East Policy,” India has been focusing on closer integration with the region. Strengthening collaboration in industries like electronics, automotive, textiles, renewable energy, and pharmaceuticals can reduce dependence on China. For example, Indian pharmaceutical producers can ensure the steady flow of affordable medicines across Southeast Asia, while ASEAN economies provide India with essential raw materials and intermediate goods.

3. Strengthening Connectivity

Resilient supply chains require robust transport and logistics systems. Major infrastructure initiatives such as the India–Myanmar–Thailand Trilateral Highway, maritime linkages, and the ASEAN–India Connectivity Plan are designed to improve regional mobility. Better transport corridors will cut down costs, reduce delays, and create alternative trade routes that do not rely on Chinese-controlled chokepoints.

4. Digital and Sustainable Supply Chains

The pandemic accelerated the push toward digital and green supply systems. India and ASEAN can cooperate on digital trade infrastructure, customs simplification, and e-commerce platforms to make supply chains faster and more efficient. At the same time, investing in renewable energy and environmentally responsible logistics will help the region transition toward sustainable production and trade models.

5. Role of Regional Institutions

Even though India opted out of the Regional Comprehensive Economic Partnership (RCEP), it continues to engage actively with ASEAN-led mechanisms such as the East Asia Summit and Indo-Pacific forums. These platforms can help develop transparent and reliable supply chain standards while encouraging cooperation in areas like semiconductors, rare earths, and healthcare goods.

6. Priority Sectors

India and ASEAN can target industries where China has traditionally dominated. Electronics, renewable energy equipment, semiconductors, and critical minerals are prime examples. Collaboration in these sectors—such as combining ASEAN’s reserves of rare earth elements with India’s growing manufacturing capability—could create new supply hubs that reduce reliance on Chinese sources.

7. Shared Geopolitical Interests

Concerns about economic security and over-dependence on China are bringing India and ASEAN closer together. Both regions aim to preserve a stable and rules-based Indo-Pacific. Therefore, enhancing supply chain cooperation is not just about economic diversification—it is also about ensuring strategic resilience in a shifting geopolitical environment.

Trends in Value Chain Linkages between ASEAN and India:

The strength of value chain linkages between two trade partners can be judged based on the volume of trade in parts and components(P&C). India implemented the ASEAN-India FTA Free Trade Agreement in 2010. Since then, India’s exports of P&C to ASEAN have increased by at an annual average growth of 6.3 per cent between 2010 and 2020. Among the ASEAN countries, India’s exports of P&C are majorly directed to Vietnam, Thailand, Singapore, Indonesia and Malaysia in 2020.

In the case of India’s imports of P&C from ASEAN, it has increased by about 5.8 per cent between 2010 and 2020. Among the ASEAN countries, India’s imports of P&C from Vietnam have significantly increased approximately 30.4%.

Moving towards sustainable value chain:

The world has experienced several setbacks in the past in terms of supply chain disruptions and the COVID-19 pandemic is the recent one. Japan experienced a massive earthquake and tsunami in 2011, which had forced factories to shut down their manufacturing such as electronic parts for automobiles, thereby disrupting the assembly lines all over the world.

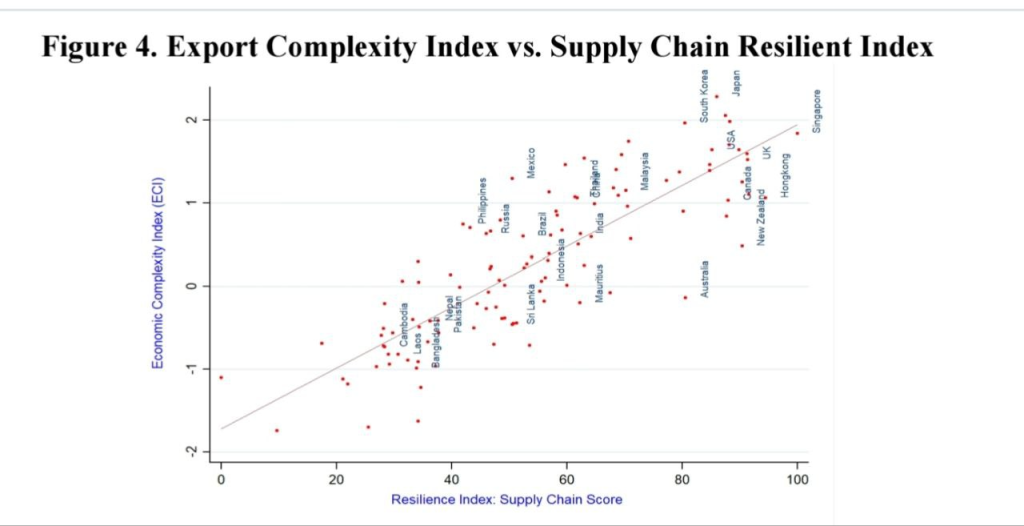

Similarly, the recent episode of flooding in Thailand has affected the computer assembly lines. Countries have been learning from the past and putting an effort to be more resilient towards the shocks. However, due to lack of quality infrastructure, and other institutional barriers some of the ASEAN countries are still subject to lower resilience in terms of supply chain and risk assessment than India, Malaysia, and Singapore. Thailand, India, and China ranked above 62 in terms of supply chain resilience, which underscores the need for improvement in resilience.

The recent supply chain disruption caused by a massive container vessel trapped in the Suez Canal has further impacted global trade, resulting in a loss of approximately US$10 billion in products, production inputs, and consumer goods. It is a significant setback for already overburdened supply chains that we are getting back on business after the COVID-19 pandemic.

How Resilient ASEAN and India with an Export of Complex Product?

ASEAN and India are in different transitions in terms of value chain linkages. Depending on whether the good is capital intensive or knowledge intensive labour intensive or natural resources, the complexity of the value chain linkages is determined. For instance, a group of large MNCs depending on the intensity of product complexity and productive knowledge, have several direct and indirect suppliers through which they buy parts and components for the production processes. Therefore, a large company’s entire supplier network can include several thousands of business linkages from all over the world.

In this context, the Economic Complexity Index measures the amount of productive knowledge and capabilities in an economy has. The country with higher ECI indicates that a country can produce and export a wide range of products and those which are commonly produced by other countries. Higher ECI tends to capture a larger share of the value added from GVCs.

Way Forward:

- Big data analytics can assist companies in streamlining their supplier selection process.

- Cloud computing is increasingly being used to facilitate and manage supplier relationships.

- Logistics and shipping processes can be significantly enhanced via automation and remote monitoring through the internet of things.

- Both ASEAN and India should promote new ideas that might arise from startups to meet the emerging challenges in supply chain resilience. For instance, Zetwerk, a Bangalore based startup that connects global companies with manufacturing facilities in India, has raised US$ 120 million to bolster its technology and expand its customer base. The company connects its small manufacturers with suppliers, logistics providers and banks.

- Artificial Intelligence, Blockchain, Augmented Reality, Internet of Things and Robotics would also facilitate the supply chain resilience through the digitalisation of supply chain linkages.

Conclusion:

ASEAN and India may consider engaging in supply chain resilience in the context of strengthening supply chains in the Indo-Pacific region through exploring alternative sources of supply of raw materials and attracting investment for sustainable supply chains in the focused areas of the food processing industry, automobiles, textiles, pharmaceuticals, electrical and electronics.

Encouraging digitization of trade documentation, trade and investment promotion activities, and the identification of sectors for collaboration, engaging in multi-stakeholder interactions would help strengthen supply chain risk management and improve end-to-end transparency to minimize the exposure of supply chain shocks.

References:

About the Author:

Akanksha Baronia is currently pursuing her postgraduate degree in Economics from Jawaharlal University, New Delhi. She is a research intern at IMPRI.

Acknowledgement:

The author thanks Aasthaba Jadeja and their team for their valuable contribution.

Disclaimer:

All views expressed in the article belong solely to the author and not necessarily to the organisation.

Read more on IMPRI:

India-UK: Literary Festivals and Shared Heritage

IREL (India) Limited (1950)