Policy Update

Srishti Sinha

Introduction

We live in a time when environmental and climate concerns are growing. The planet is experiencing significant suffering due to the global rise in carbon emissions. Green hydrogen is hydrogen gas produced using renewable energy sources like solar, wind, or hydropower through a process called electrolysis and is increasingly seen as a key solution for reducing global carbon emissions, especially in sectors that are hard to decarbonise, such as steel, fertilizers, and shipping.

Background

For India and the European Union (EU), this clean fuel offers a unique opportunity to strengthen their partnership while meeting their respective climate and energy goals. India plans to become a major producer and exporter of green hydrogen, while the EU is looking to secure affordable and sustainable imports to meet its ambitious targets. This creates a natural alignment: India can produce green hydrogen at competitive costs because of cheap renewable potential, land availability, and scale, and the EU needs reliable suppliers to meet its clean energy targets.

The Importance of this Partnership

Both India and the EU have announced ambitious plans for green hydrogen. Under the National Green Hydrogen Mission (NGHM), India aims to produce 5 million tonnes per year by 2030, supported by investments worth about ₹8 lakh crore. The mission also targets the creation of 600,000 jobs, 125 GW of renewable energy capacity, and annual reductions of nearly 50 million tonnes of carbon dioxide emissions.

On the EU side, the REPowerEU plan seeks to produce 10 million tonnes of renewable hydrogen domestically and import another 10 million tonnes by 2030. To ensure environmental integrity, the EU has laid out strict rules for what qualifies as “renewable hydrogen,” including conditions on how and when renewable electricity is used in production. From 2030, for instance, hydrogen producers will need to show that the electricity powering their electrolysers comes from renewable sources that match production on an hourly basis.

Both sides have also created institutional platforms to drive cooperation. The India–EU Trade and Technology Council (TTC) and the Energy Panel have made hydrogen collaboration a priority. In fact, India was the exclusive partner country at the European Hydrogen Week 2024, highlighting the growing importance of this relationship.

Development of this Partnership

- The partnership between India and the European Union in the green hydrogen sector began to take shape in 2021. It was during the EU-India Leaders’ Meeting in May of that year that both sides formally recognised the potential of green hydrogen as a critical area of future cooperation. This initial policy signaling marked the beginning of structured dialogue under the EU-India Strategic Partnership, placing clean energy and connectivity at the center of their discussions.

- The momentum grew in 2022, a year that witnessed major policy declarations on both sides. The European Union unveiled its REPowerEU plan, an ambitious strategy to reduce dependence on Russian fossil fuels and accelerate the clean energy transition. Within this framework, the EU committed to importing 10 million tonnes of renewable hydrogen by 2030. Around the same time, India launched its National Green Hydrogen Mission, creating a comprehensive policy foundation for developing large-scale hydrogen production and setting the stage for international trade opportunities.

- The year 2023 saw these discussions evolve into more structured cooperation. India and the EU established a joint task force on green hydrogen under the newly created Trade and Technology Council (TTC).

- In 2024, practical measures started to emerge. The EU introduced its first Hydrogen Bank auction to stabilize market prices and create clear incentives for renewable hydrogen production within Europe. On the other side, Indian energy companies such as ACME, Reliance, and AM Green began signing preliminary agreements exploring export corridors to Europe, signaling industry readiness to back political intent with capital investment.

Current Developments

- A breakthrough came in May 2025 with the signing of the AM Green-Rotterdam Corridor Agreement. This was a landmark deal between AM Green and the Port of Rotterdam Authority to build a supply chain capable of delivering up to one million tonnes of green hydrogen derivatives, such as green ammonia, from India to Europe every year. It marked the first concrete infrastructure link between the two regions for hydrogen trade and provided a blueprint for similar partnerships in the future.

- By mid-2025, the partnership moved further into implementation mode. The Government of India allocated 862,000 tonnes per year of green hydrogen production capacity across 19 companies under its National Mission, a significant step in translating policy into tangible production commitments. These developments demonstrate that while the road ahead remains challenging, the framework for a robust green hydrogen trade corridor between India and the EU is steadily taking shape.

Infographic Section

EU Green Hydrogen Targets vs Current Budget

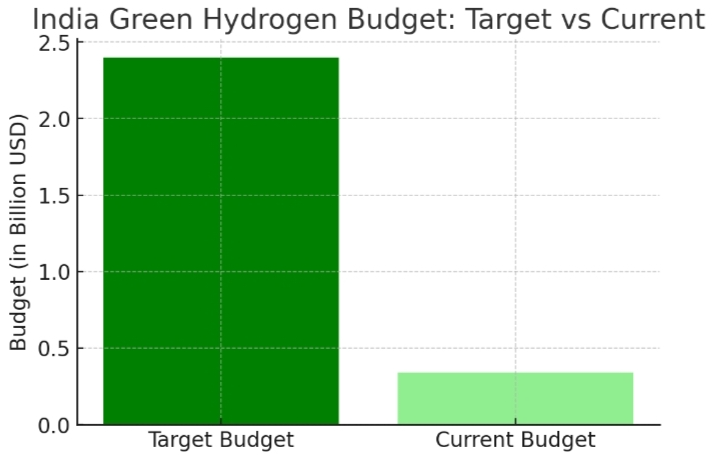

India Green Hydrogen Targets vs Current Budget

The two graphs highlight a significant gap between ambition and financial commitment for both India and the EU. The European Union has set aside an estimated $3 billion under its hydrogen strategy as a long-term target. However, so far, only about $0.8 billion has been allocated through initiatives like the EU Hydrogen Bank auctions and pilot projects. This means that while Europe has a strong policy framework and market pull, actual financial disbursement remains at an early stage.

For India, the National Green Hydrogen Mission announced an outlay of ₹19,744 crore (about $2.4 billion) for achieving the 2030 target of 5 million tonnes of production capacity. Yet, the current approved allocation of around ₹2,700 crore ($340 million) is still just a fraction of what will be required to meet this goal.

Emerging Issues and Risks

- Without accelerated financial flows, both sides may struggle to meet 2030 targets.

- Government funding alone might not suffice. Partnerships, joint ventures, and private capital mobilization will determine how quickly these targets turn into reality

- There could be several geopolitical risks; India may face competition from Middle East & North Africa exporters.

- Technical challenges like Hydrogen transport via ammonia versus liquid hydrogen and related energy losses.

- India’s standards may not align fast enough with the EU’s strict hourly-matching rule.

Way forward

The India-EU corridor is a significant initiative. However, the existing budget gaps suggest that, although there is a strong intent to trade, large-scale exports from India to the EU will require substantial financial structuring. This includes joint investments in transport infrastructure, storage facilities, and certification mechanisms. Both sides should focus on addressing these needs.

References

- Government of India. (n.d.). National Green Hydrogen Mission. https://www.india.gov.in/spotlight/national-green-hydrogen-mission

- Clean Hydrogen Observatory. (n.d.). REPowerEU hydrogen targets. https://observatory.clean-hydrogen.europa.eu/eu-policy/repowereu

- European Commission. (2023, June 20). Renewable hydrogen production: New rules formally adopted. https://energy.ec.europa.eu/news/renewable-hydrogen-production-new-rules-formally-adopted-2023-06-20_en

- European Commission. (2023). Commission Delegated Regulation (EU) 2023/1184 of 10 February 2023. https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX%3A32023R1184

- European Parliamentary Research Service. (2023). Renewable hydrogen: EU rules and implications (Briefing No. 747085). https://www.europarl.europa.eu/RegData/etudes/BRIE/2023/747085/EPRS_BRI%282023%29747085_EN.pdf

- European Commission. (2025, February 28). Second meeting of the India–EU Trade and Technology Council: Joint statement. https://digital-strategy.ec.europa.eu/en/library/second-meeting-india-eu-trade-and-technology-council-joint-statement

- Ministry of External Affairs, Government of India. (2024). 10th Meeting of the India-EU Energy Panel and 3rd Phase of the Clean Energy and Climate Partnership. https://www.mea.gov.in/press-releases.htm?dtl%2F38585%2F10th_Meeting_of_the_IndiaEU_Energy_Panel_and_3rd_Phase_of_the_Clean_Energy_and_Climate_Partnership

- European Commission. (n.d.). Innovation Fund: Competitive bidding. https://climate.ec.europa.eu/eu-action/eu-funding-climate-action/innovation-fund/competitive-bidding_en

- Hydrogen Europe. (2024). Second European Hydrogen Bank auction and Innovation Fund call 2024 launched. https://hydrogeneurope.eu/second-european-hydrogen-bank-auction-and-innovation-fund-call-2024-launched/

- Business Standard. (2025, May 26). AM Green, Rotterdam Port partner for $1 bn India-Europe green fuel corridor. https://www.business-standard.com/companies/news/am-green-rotterdam-port-partner-for-1-bn-india-europe-green-fuel-corridor-125052600800_1.html

- Port of Rotterdam Authority. (2025). AM Green and Port of Rotterdam Authority establish green energy supply chain. https://www.portofrotterdam.com/en/news-and-press-releases/am-green-and-port-rotterdam-authority-establish-green-energy-supply-chain

- European Parliament. (n.d.). Carbon Border Adjustment Mechanism (CBAM). https://www.europarl.europa.eu/legislative-train/theme-a-european-green-deal/file-carbon-border-adjustment-mechanism

- European Commission. (n.d.). Carbon Border Adjustment Mechanism (CBAM). https://taxation-customs.ec.europa.eu/carbon-border-adjustment-mechanism_en

- White & Case. (2022). EU agreement on Carbon Border Adjustment Mechanism: What you need to know. https://www.whitecase.com/insight-alert/eu-agreement-carbon-border-adjustment-mechanism

- The Times of India. (2025, August 20). Substantial progress: India eyes 10% share of global green hydrogen demand by 2030; 862,000 tonnes of production allocated across 19 firms. https://timesofindia.indiatimes.com/business/india-business/substantial-progress-india-eyes-10-share-of-global-green-hydrogen-demand-by-2030-862000-tonnes-of-production-allocated-across-19-firms/articleshow/123400868.cms

- Mint. (2025, August). Standards to evaluate performance of green hydrogen electrolysers: Draft out. https://www.livemint.com/economy/standards-to-evaluate-performance-of-green-hydrogen-electrolysers-draft-out-11754816474055.html

- Rocky Mountain Institute. (2023). The value of green hydrogen trade for Europe. https://rmi.org/insight/the-value-of-green-hydrogen-trade-for-europe/

- Reuters. (2024, July 17). EU’s green hydrogen goals not realistic, auditors say. https://www.reuters.com/business/energy/eus-green-hydrogen-goals-not-realistic-auditors-say-2024-07-17/

- Financial Times. (2024, July 16). EU hydrogen targets are ‘unrealistic’, says audit body. https://www.ft.com/content/6ea87a1c-1413-4b08-a953-a33dc729dd3c

About the Contributor

Srishti Sinha is a student of sociology at Miranda House, University of Delhi, with a keen interest in gender, cultural representation, development, public policy, and research.

Acknowledgement

The author expresses her sincere gratitude to the IMPRI team and Ms. Aasthaba Jadeja and Ms. Bhaktiba Jadeja for their invaluable guidance throughout the process.

Disclaimer:

All views expressed in the article belong solely to the author and not necessarily to the organization.

Read more at IMPRI:

National Mission for Sustaining the Himalayan Ecosystem (NM-SHE)